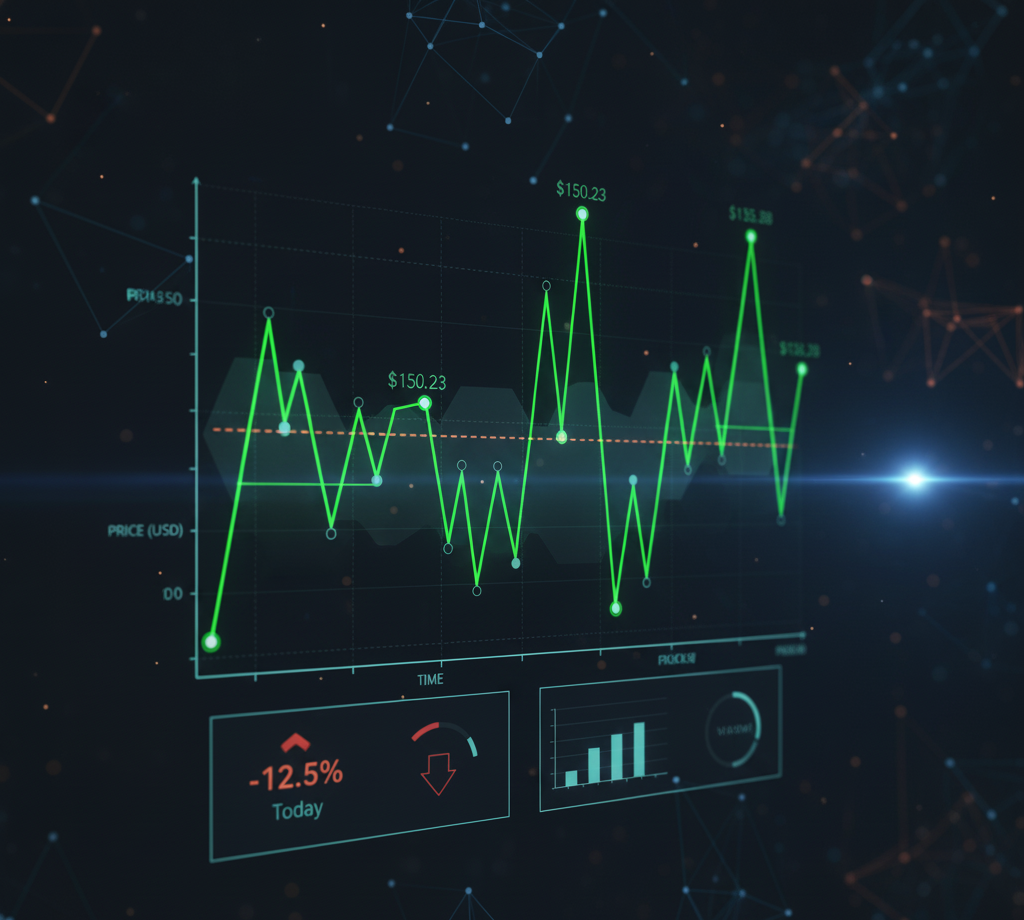

In the volatile world of chemical procurement, where raw material prices can swing wildly due to supply chain disruptions, geopolitical tensions, or fluctuating energy costs, staying ahead of the curve is essential. For manufacturers, pharmaceutical companies, and other industries reliant on chemicals like sodium hydroxide or potassium sulfate, unexpected price hikes can erode profit margins overnight. Enter forward contracts and hedging—powerful tools that allow procurement teams to lock in prices and mitigate risks. In this post, we’ll break down what these strategies are, how to implement them specifically in chemical buying, and why they’re more relevant than ever in 2025.

Understanding Forward Contracts: Your Price Lockdown Mechanism

A forward contract is a customized agreement between a buyer and a seller to transact a specific asset—such as a chemical commodity—at a predetermined price on a future date. Unlike spot market purchases, where you pay today’s price for immediate delivery, forward contracts let you secure tomorrow’s supply at today’s rates. This is particularly useful in chemicals, where feedstocks like ethylene or propylene can see 20-30% price volatility in a single quarter.

To use a forward contract in chemical procurement:

- Assess Your Needs: Forecast your chemical requirements for the next 3-12 months based on production schedules.

- Negotiate Terms: Partner with a reliable supplier to agree on quantity, quality specs (e.g., purity levels for industrial solvents), delivery timeline, and fixed price.

- Execute and Monitor: Sign the contract, often via a B2B platform that aggregates buyer orders for better leverage. Keep an eye on market shifts; if prices drop, you might face opportunity costs, but the contract shields you from spikes.

Forward contracts are over-the-counter (OTC), meaning they’re tailored but carry counterparty risk—if the supplier defaults, you’re exposed.

The Basics of Hedging: Insuring Against Price Swings

Hedging isn’t about making bets; it’s about protecting your downside. In procurement, hedging involves using financial instruments to offset potential losses from adverse price movements. Think of it as buying insurance: you pay a premium (in the form of contract costs) to cap your exposure.

In the chemical industry, hedging targets raw materials like caustic potash (KOH) or sulfuric acid, whose prices are tied to energy and mining costs. Common tools include:

Futures Contracts: Standardized exchange-traded agreements to buy/sell at a future price.

Options: Give you the right (but not obligation) to buy/sell, offering flexibility.

Swaps: Exchange fixed prices for floating ones with a counterparty.

Hedging is more complex than simple forward contracting, requiring knowledge of basis (the difference between futures and spot prices). But for chemical buyers, it can stabilize costs amid global events like the 2024 Red Sea disruptions.

Applying Forward Contracts in Chemical Procurement: Step-by-Step

Let’s get practical. Suppose you’re a fertilizer producer procuring ammonia, whose price has surged 15% year-over-year due to natural gas volatility.

Market Analysis: Use price forecasting tools to predict ammonia trends.

Select Suppliers: Identify vetted vendors via platforms like those aggregating B2B orders.

Structure the Contract: Agree on 100 tons/month at $500/ton for six months, with clauses for force majeure (e.g., supply shortages).

Integrate with Inventory: Align deliveries with your just-in-time needs to avoid storage costs.

Review Annually: Adjust based on contract performance and market outlook.

This approach not only locks in costs but fosters long-term supplier relationships, reducing negotiation fatigue.

Hedging Strategies Tailored for Chemical Buyers

For broader protection, layer hedging atop forward contracts. A chemical manufacturer facing ethylene price risks might:

Long Hedge: Buy futures to lock in purchase prices if you’re a buyer.

Portfolio Hedging: Combine forwards for immediate needs with options for upside potential.

Natural Hedging: Offset risks by diversifying suppliers across regions, blending financial tools with operational tweaks.

In practice, companies hedge 50-70% of exposure to balance protection and flexibility, using exchanges like CME for chemical-linked commodities. For instance, hedging KOH involves monitoring mining outputs and locking in via swaps to counter inflation.

Benefits, Risks, and Best Practices

Benefits:

- Cost Predictability: Stabilize budgets, improving cash flow forecasting.

- Margin Protection: Chemical firms using hedges have outperformed peers by 5-10% in volatile years.

- Strategic Edge: Enables aggressive pricing in sales contracts.

Risks:

- Opportunity Cost: If prices fall, you’re stuck at higher rates.

- Basis Risk: Futures might not perfectly track your chemical’s spot price.

- Complexity: Requires expertise; missteps can amplify losses.

Mitigate with a robust risk policy: Start small, train your team, and consult advisors. In 2025, with AI-driven forecasting, hedging is more accessible than ever.

Wrapping Up: Secure Your Supply Chain Today

Forward contracts and hedging aren’t just financial jargon—they’re lifelines for chemical procurement in an unpredictable market. By locking in prices and offsetting risks, you can focus on innovation rather than firefighting. If your team hasn’t explored these yet, audit your exposures and pilot a small contract. The stability they bring could be the difference between thriving and merely surviving.

Get the White Paper: Streamlining Procurement Processes for SMB Manufacturers

Get instant access to our white paper on Must-Know Procurement Tips for SMB Manufacturers by filling out the form below.

Get in Touch

Learn more about Lasso supply chain solutions for SMB manufacturers

Please complete the form and we will be in touch as soon as possible.