In the fast-paced world of manufacturing as of 2025, supply chain disruptions, fluctuating raw material prices, and geopolitical tensions continue to challenge procurement leaders. Gone are the days of reactive purchasing—today’s manufacturers need a proactive, data-driven approach to secure cost efficiencies, mitigate risks, and drive innovation. Enter the procurement category strategy: a tailored roadmap for managing specific spend categories like raw materials, components, or machinery. By blending internal data (your company’s own insights) with external data (market intelligence and benchmarks), you can transform procurement from a cost center into a strategic powerhouse. In this post, we’ll explore how to build one step by step, with real-world tips for manufacturers.

Why Category Strategies Matter for Manufacturers

A procurement category strategy groups similar goods or services—think “steel alloys” or “precision tooling”—into manageable buckets, allowing you to optimize spend, supplier relationships, and processes holistically. For manufacturers, this is crucial: direct materials often account for 60-80% of total costs, and poor sourcing can halt production lines.

The benefits are clear: expect 10-20% cost reductions through consolidated negotiations, stronger supplier partnerships that foster innovation (like custom components), and better risk management against volatility in commodities like lithium or semiconductors. Plus, in an era of AI and analytics, data integration supercharges these outcomes, enabling predictive sourcing and automated decision-making.

Harnessing Internal Data: Start from Within

Your internal data is the foundation—it’s the “what’s happening now” view of your operations. Begin by conducting a spend analysis to uncover patterns in your procurement footprint.

- Spend Analytics: Pull three years of data from ERP systems, invoices, and contracts to categorize expenditures. For a manufacturer, this might reveal that 40% of your budget goes to “mission-critical components” from fragmented suppliers, highlighting consolidation opportunities.

- Supplier Performance Metrics: Track KPIs like on-time delivery (vital for just-in-time manufacturing), quality defect rates, and total cost of ownership (TCO), including hidden fees like shipping or downtime.

- Stakeholder Input: Engage internal teams—production, engineering, finance—to map current processes and forecast needs. For instance, if R&D anticipates a 15% volume increase in EV battery materials, factor that in.

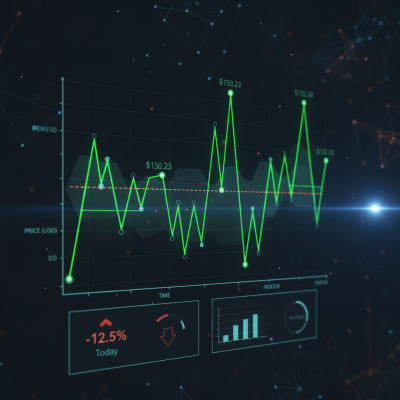

Tools like spend analytics platforms make this seamless, turning raw data into dashboards for quick insights. Without this baseline, your strategy risks being built on assumptions.

Incorporating External Data: Broaden Your Horizon

External data provides the “what’s happening out there” context, helping you benchmark and anticipate shifts. In manufacturing, where global events like trade tariffs impact steel pricing, this is non-negotiable.

- Market Intelligence: Use industry reports for trends, such as rising demand for sustainable materials or supplier consolidation in the automotive sector. Benchmarks reveal if your aluminum costs are 10% above peers.

- Supplier Market Scans: Assess the supplier landscape with tools like the Kraljic Matrix, plotting categories by supply risk and profit impact (e.g., high-risk rare earth metals vs. low-risk fasteners).

- Economic and Regulatory Data: Monitor inflation forecasts, ESG compliance requirements, or AI-driven price predictions to stay ahead.

Integrate third-party sources like databases or RFIs (requests for information) to evaluate supplier financials and roadmaps—ensuring they’re stable for long-term partnerships. For manufacturers, this external lens can spot diversification opportunities, like shifting from single-source Asian electronics to regional alternatives amid tensions.

Step-by-Step Guide: Crafting Your Category Strategy

Building a strategy isn’t one-and-done; it’s iterative. Here’s a practical framework adapted for manufacturers, drawing on proven sourcing processes.

Step 1: Define and Profile Your Categories

Group spend into logical categories (e.g., “raw metals” or “MRO supplies”) using internal data. Create a category profile: Document specs, volumes, and TCO models. Aim for 5-10 core categories to start.

Step 2: Conduct Internal Analysis

Dive into your data for an “as-is” snapshot. Map procurement flows—direct materials might be ERP-automated, while indirect services are manual. Identify pain points, like supplier delays causing 5% production losses.

Step 3: Perform External Analysis

Layer in market data: Use PESTLE (Political, Economic, etc.) or Porter’s Five Forces for industry dynamics. Scan suppliers via RFIs, evaluating capabilities and risks. For a chemical manufacturer, this might uncover volatile feedstock prices due to energy shifts.

Step 4: Develop the Strategy

Synthesize insights into actions: Set goals like 15% cost savings or 95% on-time delivery. Prioritize tactics—e.g., strategic alliances for high-value categories or e-auctions for commodities. Assign owners and timelines.

Step 5: Implement, Monitor, and Iterate

Roll out with pilot categories, track via KPIs, and adjust quarterly. Leverage AI for real-time alerts on price spikes. Engage stakeholders throughout for buy-in.

| Step | Key Data Sources | Manufacturer Example |

|---|---|---|

| 1. Define Categories | Internal spend logs | Grouping “plastic resins” by usage volume |

| 2. Internal Analysis | ERP, contracts | Analyzing defect rates in component sourcing |

| 3. External Analysis | Market reports, RFIs | Benchmarking steel prices against global indices |

| 4. Develop Strategy | Combined internal/external | Negotiating volume discounts with vetted suppliers |

| 5. Implement & Monitor | KPIs, dashboards | Tracking 10% YoY savings in tooling category |

Wrapping Up: Your Path to Procurement Excellence

In 2025, manufacturers who master data-driven category strategies aren’t just surviving—they’re thriving amid uncertainty. By marrying internal visibility with external foresight, you’ll unlock savings, resilience, and growth. Ready to dive in? Start with a spend audit this week and explore tools like AI analytics for the edge.

Get the White Paper: Streamlining Procurement Processes for SMB Manufacturers

Get instant access to our white paper on Must-Know Procurement Tips for SMB Manufacturers by filling out the form below.

Get in Touch

Learn more about Lasso supply chain solutions for SMB manufacturers

Please complete the form and we will be in touch as soon as possible.