In today’s fast-paced business landscape, procurement isn’t just about buying supplies—it’s a strategic powerhouse driving cost efficiency, risk mitigation, and sustainable growth. As we navigate 2025, with global supply chains still recovering from disruptions and inflation pressures lingering, organizations are under immense scrutiny to optimize every dollar spent. Enter Key Performance Indicators (KPIs): the compass for procurement teams to measure success, uncover inefficiencies, and align efforts with broader business objectives. But tracking KPIs alone isn’t enough; integrating advanced analytics transforms raw data into actionable insights that propel strategic goals forward. In this post, we’ll explore the procurement KPIs that truly matter, how to harness analytics for deeper alignment, and practical steps to make it all happen.

Why Procurement KPIs Are Your North Star

Procurement KPIs are quantifiable metrics that evaluate the effectiveness of your sourcing, purchasing, and supplier management processes. They go beyond vanity metrics like total spend, focusing instead on outcomes that impact the bottom line and long-term resilience. By tracking these, teams can identify bottlenecks, negotiate better terms, and ensure compliance—ultimately contributing to organizational agility.

The benefits are clear: data-driven decisions lead to improved operations, enhanced forecasting, and stronger supplier partnerships. In an era where 64% of procurement leaders cite analytics as key to controlling costs and managing risks, ignoring KPIs means leaving money on the table. The real magic happens when these metrics align with strategic goals, such as sustainability targets or innovation roadmaps, turning procurement from a cost center into a value creator.

Top 10 Procurement KPIs to Track in 2025

Drawing from industry benchmarks, here are 10 essential KPIs that procurement pros should prioritize this year. These cover cost control, efficiency, supplier performance, and risk—tailored for the complexities of modern supply chains. We’ve included brief definitions, formulas where applicable, and why they matter.

Spend Under Management (SUM) The percentage of total organizational spend controlled through procurement processes. Formula: (Managed Spend / Total Spend) × 100. Why it matters: It highlights gaps in oversight, like uncontrolled “maverick spend,” and supports strategic supplier consolidation for better leverage.

Maverick Spend Rate Unauthorized purchases outside approved channels. Formula: (Maverick Spend / Total Spend) × 100. Why it matters: High rates signal compliance issues and missed savings opportunities; reducing it can unlock 5-10% in annual cost reductions.

Purchase Price Variance (PPV) The difference between expected and actual purchase prices. Formula: (Actual Cost – Standard Cost) / Standard Cost × 100. Why it matters: Positive variances indicate savvy negotiations; tracking helps refine pricing strategies amid volatile markets.

Supplier Lead Time Average time from order placement to delivery. Formula: Total Lead Time / Number of Orders. Why it matters: Shorter times mean faster production cycles and fewer stockouts, directly tying into operational efficiency goals.

Cost Savings and Avoidance Reductions in spend through negotiations or alternatives, plus prevented future increases. Formula: (Baseline Cost – Actual Cost) for savings; estimated future costs avoided for avoidance. Why it matters: Quantifies procurement’s direct ROI, aligning with corporate cost-cutting mandates.

Supplier Quality Rating Score based on defect rates, on-time delivery, and compliance. Formula: Weighted average of quality metrics (e.g., 40% defects, 30% delivery). Why it matters: Ensures reliable partners, reducing rework and boosting customer satisfaction.

Procurement ROI Return generated from procurement activities relative to costs. Formula: (Savings – Procurement Costs) / Procurement Costs × 100. Why it matters: Proves the function’s value to executives, justifying investments in tools or talent.

On-Time Delivery Rate Percentage of orders delivered as scheduled. Formula: (On-Time Deliveries / Total Deliveries) × 100. Why it matters: Critical for just-in-time inventory; low rates expose supply chain vulnerabilities.

Supplier Risk Score Composite index of financial, operational, and geopolitical risks. Formula: Weighted score from factors like credit ratings and past performance. Why it matters: In 2025’s uncertain world, it aids diversification and disruption-proofing.

Procurement Cycle Efficiency Time from requisition to payment divided by value-added steps. Formula: (Total Cycle Time / Value-Added Time) × 100. Why it matters: Streamlines processes, cutting administrative drag and freeing resources for strategy.

These KPIs aren’t one-size-fits-all—select based on your industry’s pain points, like sustainability in manufacturing or compliance in pharma.

Aligning Analytics with Strategic Goals: From Data to Decisions

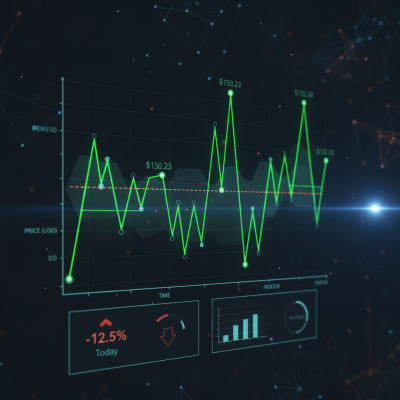

Analytics elevates KPIs from static reports to dynamic foresight. In 2025, procurement analytics encompasses descriptive (what happened?), diagnostic (why?), predictive (what might?), and prescriptive (what should we do?) methods, drawing from internal ERP data and external market intel. This alignment ensures procurement supports C-suite priorities like net-zero emissions or digital transformation.

For instance, predictive analytics on supplier lead times can forecast disruptions, allowing proactive sourcing that aligns with resilience goals. Tools like AI-powered dashboards integrate disparate data sources, offering real-time visibility into KPIs like SUM or risk scores. A use case: Comparing supplier prices via analytics streamlines negotiations, directly tying to cost-avoidance targets.

To align effectively:

- Map to Objectives: Start with your org’s strategy—e.g., if innovation is key, prioritize KPIs like supplier quality for R&D materials.

- Integrate Data Silos: Use platforms connecting POs, invoices, and vendor portals for holistic views.

- Set Targets with Benchmarks: Aim for 80%+ on-time delivery, adjusting via historical trends and industry standards.

- Foster Collaboration: Share dashboards with finance and ops to cascade insights organization-wide.

Best Practices for Implementation and Pitfalls to Avoid

Roll out these KPIs with a phased approach: Audit current processes, select 5-7 metrics, automate tracking via software, and review quarterly. Communicate wins to stakeholders to build buy-in—transparency drives action.

Watch for traps like metric overload (stick to what’s actionable) or poor data quality (invest in clean integrations). Finally, blend lagging (e.g., past savings) and leading indicators (e.g., risk scores) for forward-looking strategy.

Wrapping Up: KPIs as Catalysts for Procurement Excellence

In 2025, the procurement teams winning big aren’t just tracking KPIs—they’re weaving analytics into the fabric of strategic goals, turning data into dollars saved and risks neutralized. By focusing on metrics like SUM, lead times, and ROI, and leveraging tools for predictive power, your function can evolve from tactical to transformative. Ready to audit your KPIs? Start small, measure often, and watch your impact soar.

Get the White Paper: Streamlining Procurement Processes for SMB Manufacturers

Get instant access to our white paper on Must-Know Procurement Tips for SMB Manufacturers by filling out the form below.

Get in Touch

Learn more about Lasso supply chain solutions for SMB manufacturers

Please complete the form and we will be in touch as soon as possible.