In the rapidly evolving landscape of electrical devices—ranging from consumer electronics like smartphones and laptops to industrial systems such as power distribution units and data center infrastructure—the design approach plays a pivotal role in how organizations manage procurement. Modular designs, where components are interchangeable and can be sourced separately, contrast with fully integrated designs, where all parts are tightly interwoven into a single unit. Procurement coordination involves aligning suppliers, managing inventories, ensuring quality, and optimizing costs across the supply chain. This blog post explores the nuances of these two approaches, their advantages and challenges in procurement, and real-world implications to help businesses make informed decisions.

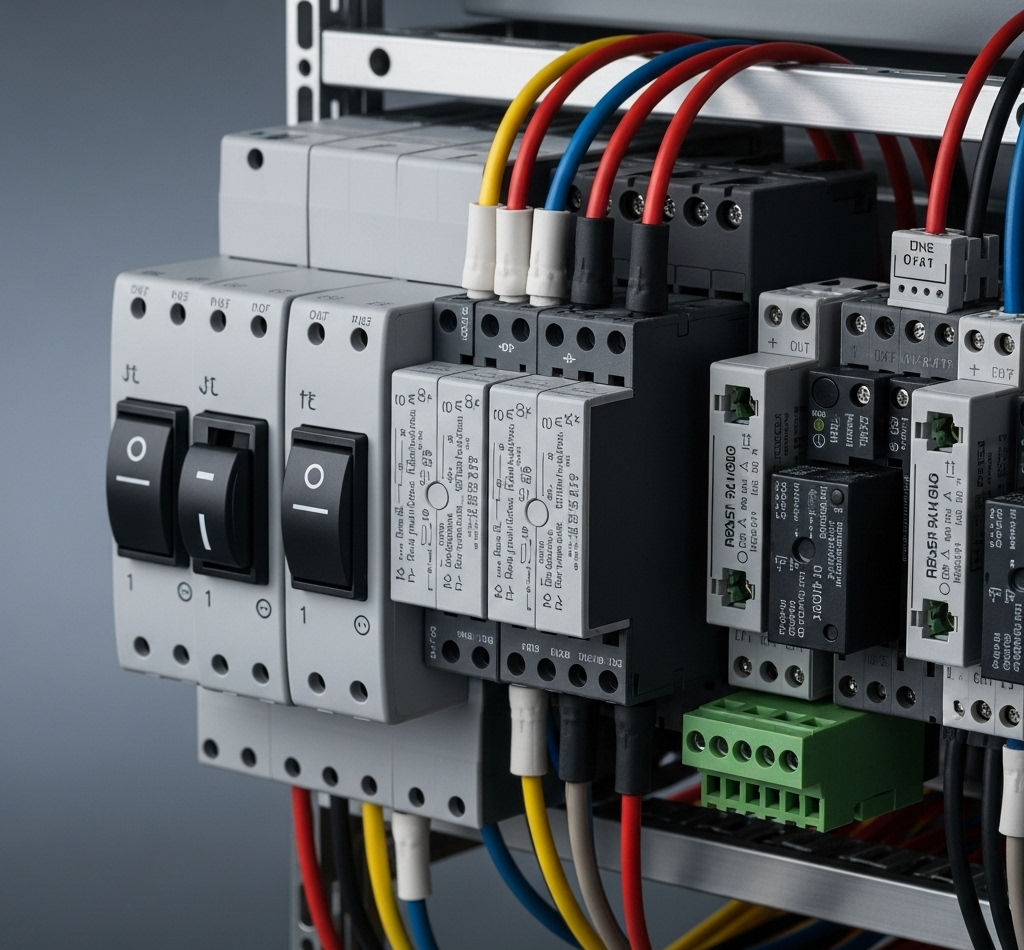

Modular electrical devices are built with standardized, interchangeable components that can be easily assembled, upgraded, or replaced. Examples include modular electric rooms (MERs) in data centers, where prefabricated assemblies contain electrical infrastructure like switchgear and transformers, or consumer products like the Framework laptop, which allows users to swap out RAM, screens, and other parts with minimal tools. In procurement terms, this design promotes flexibility by enabling sourcing from multiple specialized suppliers for pre-assembled subsystems, such as coils or inductors in electrical systems.

Key benefits for procurement coordination include:

However, modular approaches require robust standardization to avoid compatibility issues, and they can initially demand more upfront coordination to align interfaces.

Fully integrated electrical devices feature tightly coordinated components with custom interfaces, creating a seamless, all-in-one product. Think of traditional smartphones or integrated electrical panels where parts like circuits and housings are non-replaceable without specialized tools. This design prioritizes performance optimization and compactness, as exemplified by Apple’s iPhone, where internal components are customized for efficiency.

For procurement coordination, the strengths lie in simplicity:

Drawbacks include:

To highlight the differences, here’s a side-by-side comparison of key procurement aspects:

| Aspect | Modular Design | Fully Integrated Design |

|---|---|---|

| Supplier Management | Dispersed, multiple specialized suppliers; promotes competition and innovation. | Fewer, closely tied suppliers; emphasizes long-term partnerships. |

| Flexibility & Scalability | High; easy to swap components or scale via prefabrication tiers. | Low; changes require redesigning the entire system. |

| Cost Structure | Lower long-term costs through repairs/upgrades; potential higher initial setup. | Lower upfront for mass production but higher for maintenance. |

| Coordination Effort | Requires standardization but allows parallel sourcing; e.g., offsite testing in MERs reduces onsite work. | Intensive upfront collaboration; simpler ongoing management. |

| Risk & Resilience | Mitigates risks via interchangeability; better for volatile supply chains. | Higher risk from supplier dependency; e.g., disruptions halt production. |

| Sustainability | Supports reuse and reduces waste; aligns with right-to-repair trends. | Generates more e-waste due to non-repairable units. |

This table underscores that modular designs excel in adaptable, resilient procurement, while integrated ones suit stable, high-volume scenarios.

Several industries illustrate these dynamics:

These examples show that successful procurement hinges on aligning design with supply chain strategy.

Choosing between modular and fully integrated electrical devices for procurement coordination depends on your organization’s priorities—flexibility and sustainability favor modular, while efficiency in mass production leans toward integrated. As industries face supply chain disruptions and sustainability pressures, hybrid approaches may emerge as the ideal. By evaluating your needs against these frameworks, businesses can optimize coordination, reduce risks, and drive innovation.

© 2025 Lasso Supply Chain Software LLC

Get instant access to our report on the Top Procurement Trends of 2025.

Get instant access to our report on the Top Procurement Trends of 2025 by filling out the form below.